CASE STUDIES

INTELLIBRIEF

Coming soon...

Restructure

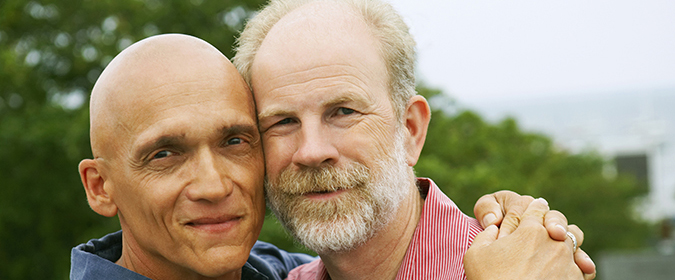

Derrick is a long term expatriate, 60 years old and a permanent resident of Hong Kong. Having just left a relationship, he is currently single. He does expect to meet his next “Mr Right” at some point and wants to ready himself for this eventuality. He now feels financially comfortable, but he wants to simplify his situation because starting a new relationship is complicated enough. He also wants to see if his current portfolio of investments is in alignment with his long term goals, which have most likely changed since the investments were initially made.

Derrick worked overseas for most of his career; he earned a large portion of this in a few European countries before his posting in Asia where he realized he wants to spend the rest of his working career. In the process of all his moves and assorted job assignments, he enrolled in a number of regular savings plans and a few small lump sum investment programs along the way.

Derrick is a marketing executive, and had no consistent financial advice over the 30+ years of his career so far. He was moving around quite a bit from one company to another as well as taking different positions in most of these companies. Not knowing any better, he enrolled in several independent investment schemes all managed separately. This eventually resulted in him having total investments of nearly Euro1,000,000 spread over seven plans.

Because of industry consolidation, some of his original providers were no longer open for business, but he still owned the assets he had invested. Fund performance had suffered quite a bit as a consequence of this lack of attention. The portfolio as a whole was underperforming Derrick’s expectations largely due to the lack of regular portfolio management and many of these investments were quite outdated. Finally, he was still committed to high fee structures from legacy advisors that no longer even existed.

Derrick’s Discretion Wealth Management consultant reached out to each of the providers and did a full review of the terms and conditions for each plan. The consultant realized that it would be far more efficient to consolidate the seven plans into one. Providers of most of the plans tried to apply penalties for termination, but DWM was able to rebate this amount in full as part of the restructuring process.

Derrick now has a more strategized, more transparent portfolio. In addition to this, it provides greater access to funds at greatly reduced servicing and management costs which has significantly enhanced performance compared to his previous situation. Derrick decided to use the Discretionary Management Service in line with his risk profile. As part of this service he receives monthly portfolio valuations & global market reports as well as quarterly reviews with his Discretion Wealth Management consultant.

Since restructuring the portfolio in 2011 Derrick has enjoyed performance with double digit returns each year without taking on any additional risk. At the same time, he has significantly reducing the service cost of his investments. His next Mr. Right will be very happy! And because of his foresight, Derrick’s investments will remain protected in the future.